CONTACT INFORMATION

You can contact us any way that is convenient for you. We are here to help you sell or buy your next property.

- 722 Farris Road | Conway, Arkansas 72034

- +1 (501) 733 3591

- grealty1@gmail.com

“Risk comes from not knowing what you’re doing.” – Warren Buffet

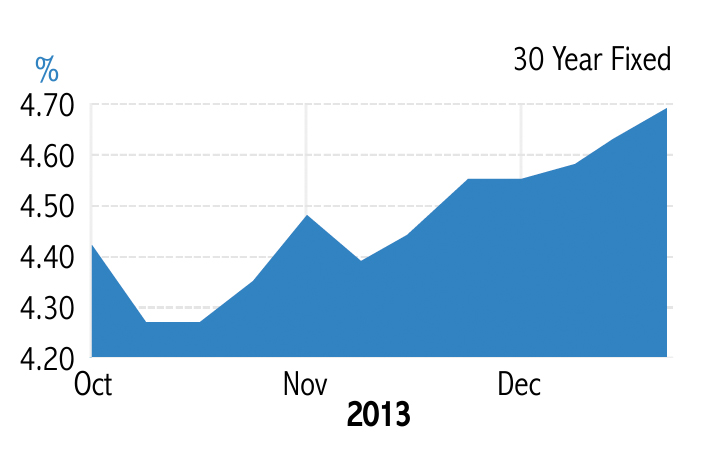

Mortgage Rates 10/13-12/13

Looking back at 2013 and forward to the year ahead, it doesn’t take much to identify the biggest source of financial risk we’re all facing—Obamacare. You might already be feeling the effects directly. If you aren’t, and you’re thinking you’ve got your bases covered because you’re on an employer health insurance plan, just wait. It may be that the law affects some directly, through skyrocketing health insurance premiums and the loss of coverage. For others, those direct effects will undoubtedly have an indirect ripple effect throughout our consumer-driven economy. For now though, only God knows how big those ripples will be. This unprecedented unknown is causing many would-be home sellers and buyers to take the wait-and-see approach. Not knowing how to plan financially for the implications of Obamacare may be making the decision to sell and/or buy a new home seem a bit too risky. Maybe that’s you.

While Obamacare is the source of many financial unknowns in 2014, at the start of this new year, there is one glaringly obvious known for potential home buyers—mortgage rates are rising. Granted, I do have some considerable bias in my assessment, since people buying and selling houses tends to be in my best interest. However, if you can put all of that aside for a moment and leverage a bit of good ole common sense, I think you’ll agree that rates are on the rise. I have a friend that built a new home a couple of years ago and locked-in a 30 year fixed-rate 2.75% mortgage. Ya…those days are long gone now. If you’re planning to buy in the near future, chances are rates will only go higher the longer you wait. Keep that in mind while you’re browsing through homes on Zillow or Trulia.

[Before you continue reading this post, you need to read this one if you haven’t. It will help you understand the significance of what the Federal Reserve is doing right now. Once you understand how the Fed’s purchases of US Treasury Bonds have been keeping interest rates artificially low for several years, the obvious question will be: “What would happen if the Federal Reserve were to slow its buying frenzy a bit?”…Three weeks ago, they did. Click here for a recap.]

Rising Mortgage Rates. Now.

Three weeks ago the Fed announced it would begin to “taper” its US Treasury purchases. Interest rates immediately began rising. In fact, rates have continued rising for three consecutive weeks since that announcement. I’ve heard some say that rates have basically plateaued. However, I believe that rates have begun to rise and will continue rising, arguably, for the foreseeable future. So, why the sudden spike in rates? Well, since ’08 the Federal Reserve has been a major source of income for the US Treasury. Like a college kid with a dream part-time job—[the kind with little work and pay that’s almost too good to be true]. Since ’08 this has been a big deal for the US Treasury because it has lots of bills to pay—like some college kids who get suckered into applying for credit cards. It’s free money…right? Like some have done with newly acquired plastic money, the Treasury has been on a spending spree [Click here to see the tab adding up in real-time]. Its most recent statement has a whopper of a line-item on it—Obamacare. You see, the US Treasury is like a bucket with a hole in the bottom. As long as the hole is there, it can’t and won’t hold water. But, if you get a fire hose you might be able to spray water into it faster than the water can spill out of the bottom—in which case, the bucket may actually fill up. This is only temporary though. Incidentally, you’ll be racking up a huge water bill in the process. If you turn the hose off, or if you decrease the flow of water through the hose, that bucket’s gonna be empty really quick.

Mortgage Rates Will Continue Rising

If the Fed continues to curtail its purchase of US Treasuries, the prime rate—and mortgage rates—will only continue to rise. If you’ve been on the fence because of the financial uncertainty of Obamacare, mortgage rates are one area where you needn’t feel uncertain. If you need to sell in order to buy that new house, the time to list your house is now. If you’ve been renting and postponing a buying decision for some reason, now is the time to get pre-approved for a loan and locked-in to a mortgage rate so you can buy a home. In the next couple of days I’ll be posting a specific breakdown of all of the costs involved in buying a home—from Offer to Closing. [UPDATE: See that list here.] That way, at least you’ll be have those unknowns out of the way. I’ll also be posting a comparison of the costs for a loan at today’s rates vs a loan at 5%, 5.25%, 5.5%, and so on. Be sure to check back to see exactly how much it will cost, long-term, if you wait and buy 6 or 12 months from now at a higher rate. This is information you need to know if you’re seriously considering buying a home in 2014.

You can contact us any way that is convenient for you. We are here to help you sell or buy your next property.

Was the information in this blog helpful?

Share This Page